As of September 14th, 2019 payment gateways now require additional security steps regarding “SCA” for customer purchases in the European Union.

This will trigger the 3DS payment gateway security features for the customer to authorize their payment.

What is SCA?

Strong Customer Authentication (SCA) is a European regulation set in place on September 14th, 2019 to reduce fraud and make online payments more secure for purchasing customers by adding additional security steps for purchases and subscriptions.

When is SCA applied?

SCA primarily applies to but is not limited to, EU businesses that are selling to EU based customers and match any of the following criteria

(a) accesses their payment account online;

(b) initiates an electronic payment transaction;

(c) carries out any action through a remote channel which may imply a risk of payment fraud or other abuses.

Most card payments and all bank transfer payments will require SCA.

When could SCA not be required?

There are scenarios in which SCA may not be required for the customer’s purchase.

What is 3DS?

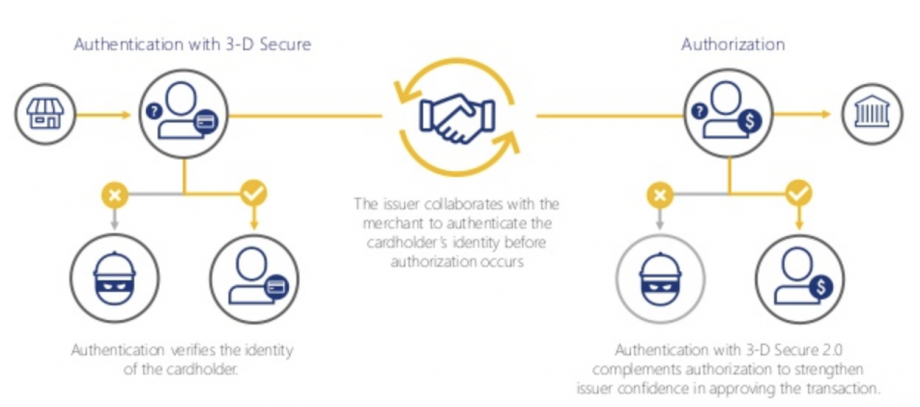

3D Secure (3DS) is a fraud prevention measure that acts as an additional layer of security when taking card payments. It gives customers a secure 2 step authentication before they can purchase online; ensuring that they’re using the correct card details to help protect against card payment fraud.

3D Secure (3DS) is a fraud prevention measure that acts as an additional layer of security when taking card payments. It gives customers a secure 2 step authentication before they can purchase online; ensuring that they’re using the correct card details to help protect against card payment fraud.

3DS serves as the authentication method required by SCA regulations.

What Payment Gateways Support 3DS?

- Authorize.net: Not Supported

- Braintree: Supported

- EasyPayDirect: Not Supported

- PayPal: Not required

- Stripe: Supported

How do vendors handle 3DS for their payment gateways?

NOTE: Please consult with your payment gateway to ensure they do not require any additional actions to set up 3DS.

- Braintree: Vendors using Braintree will need to ensure 3DS is enabled in their account. You can check if your BT account has 3DS enabled by following the guide here: https://articles.braintreepayments.com/guides/fraud-tools/3d-secure#confirm-setupIf 3ds is not enabled for your BT account, please contact BT support to get it enabled.

- Stripe: Stripe handles this automatically to enable 3DS on your Stripe account. No additional action on the Stripe account should be required.

NOTE: If using the API to run customer transactions(developer option), you will need to follow the additional SCA/3DS setup instructions located on the New Purchase API call.

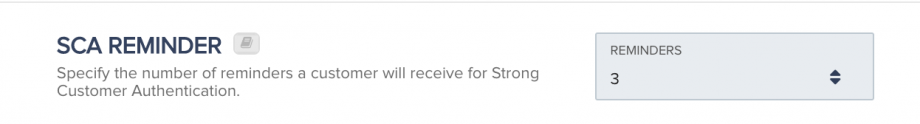

After you enable 3DS for the payment gateway (if needed) go to the platform settings to set your SCA subscription billing reminders in the subscription section for the SCA authentication emails that will be sent to customers to authenticate their transaction if SCA/3DS is triggered. Set the number of SCA reminders (1 per day) you’d like to send your customers before marking the transaction as failed

How will 3DS work for customers?

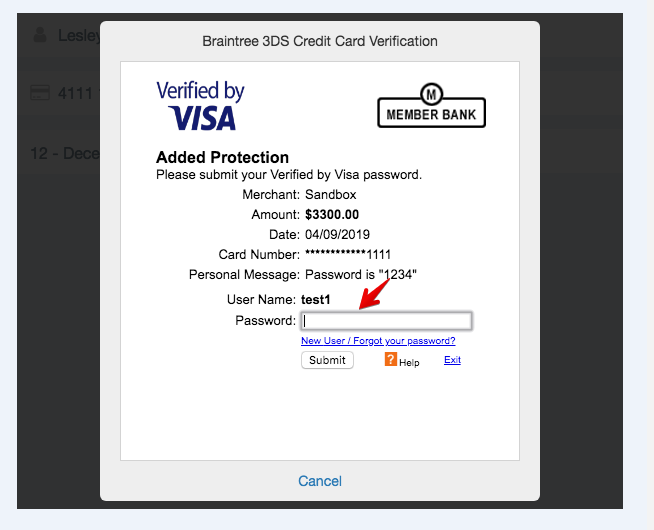

1. After entering their checkout info and clicking buy for a subscription-based product, European customers or customers required to use 3ds with their payment method will see a modal window popup (from the payment gateway the vendor is using to sell the product) The modal is created and controlled by the payment gateway.

PayKickstart has no control over this modal.

-

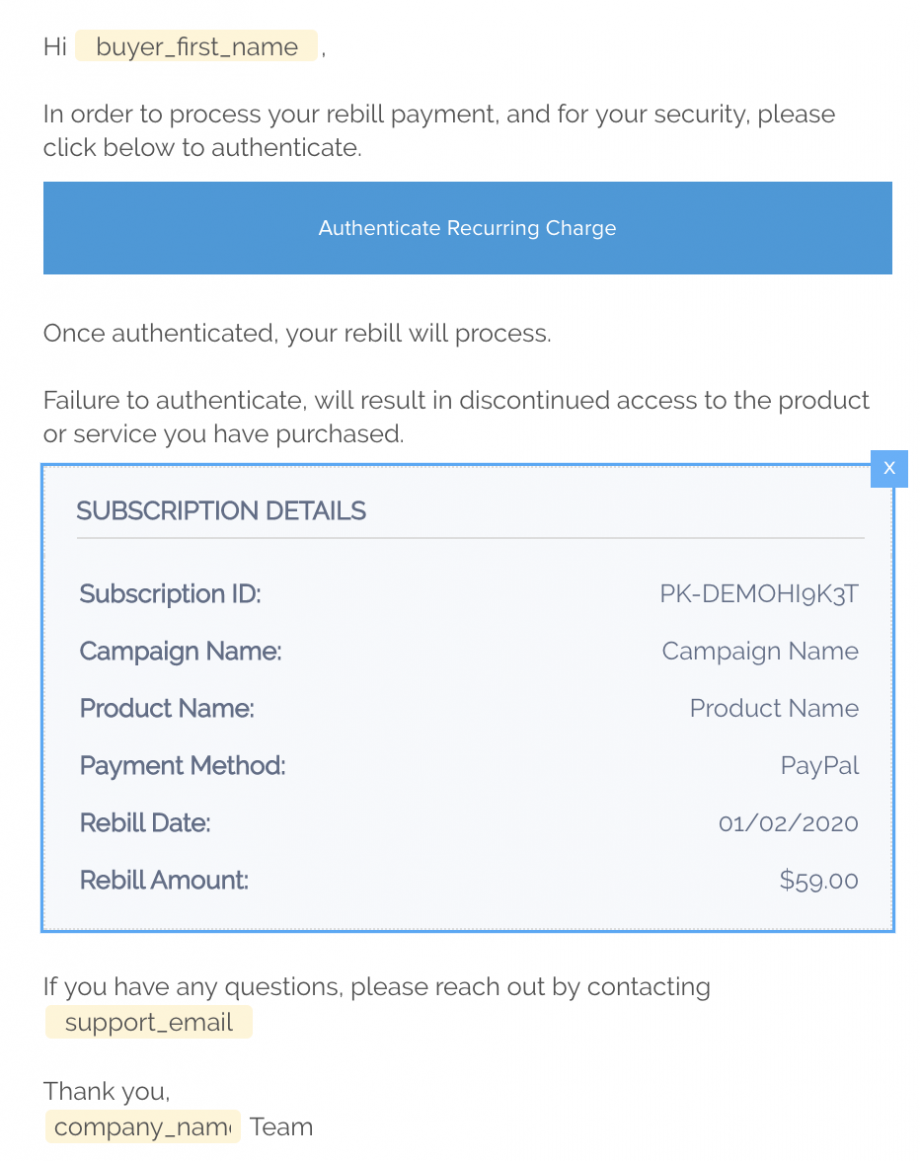

- NOTE: If the customer does not authenticate the transaction within the allotted grace period(1-3 days: contact vendor of product for their grace period), the transaction will be marked as failed.

- NOTE: If the customer does not authenticate the transaction within the allotted grace period(1-3 days: contact vendor of product for their grace period), the transaction will be marked as failed.

4. Our system confirms the customer’s rebill transaction and Paykickstart will attempt to process the transaction as normal.