Occasionally, your customers may submit charge disputes for their transactions relating to your Connect payment processing account.

Some typical reasons for customer transaction disputes are:

FRAUD: This is the most frequent reason for a dispute and happens when a customer claims that they didn’t authorize the payment. The customer’s payment method may have been compromised and is being used by a fraudulent person.

Product defective or not as described (most commonly seen with digital goods): This can occur if the product/services are not in working condition or the product/service is different than described in the sales copy.

Product/Services Not Received: This can occur if the product purchased was not delivered to the customer or if the services offered were not fully completed.

Duplicate charge: This can occur if the customer believes they were charged for the product/services in duplicate by vendor error.

Recurring billing (customer did not agree to recurring billing): This can occur if the customer is being billed for a subscription they did not agree to. Adding a TOS requirement to your checkout is a great way to help with this dispute reason.

Subscription canceled: This can occur if the customer believes they have previously canceled their subscription, but are still being charged.

Unrecognized charge: Another common reason, this typically occurs if the customer doesn’t recognize the charge as it appears on the billing statement from their payment issuer.

How to Handle Disputes in your “Connect” account:

Ensure your products/services are high quality to prevent disputes: If you are cutting corners, it tends to cause more harm than good. Check your product offering to ensure your customer has a quality experience from purchase to delivery and use.

Contact the customer to discuss the dispute: Disputes are commonly placed by the customer for reasons that can be resolved via a simple conversation with them.

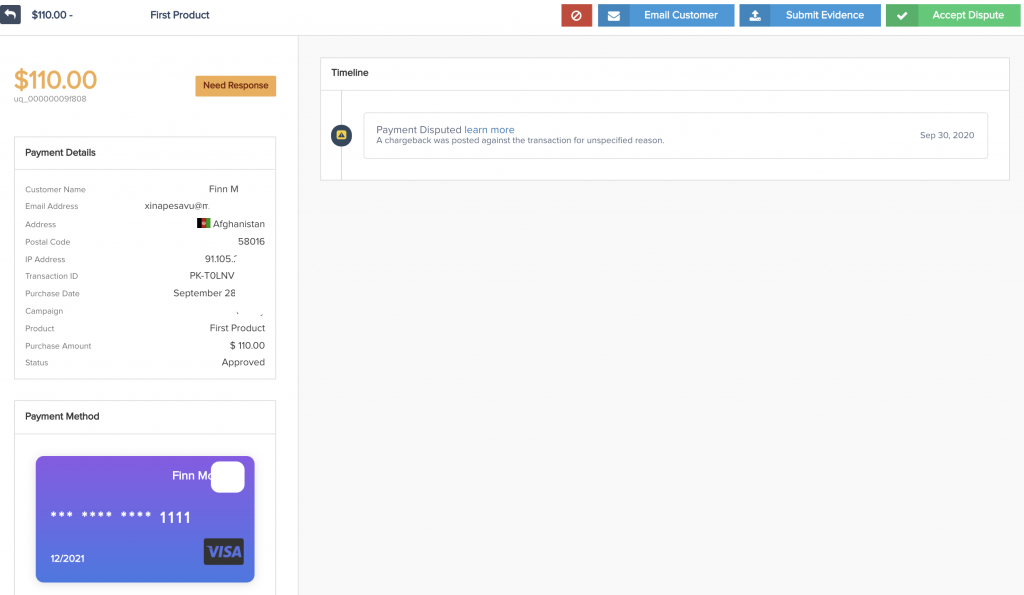

Submitting Dispute Evidence: In the event you need to contest the customer dispute submission, you can submit evidence such as your refund policy, terms of service acceptance and more via the Dispute submission section.

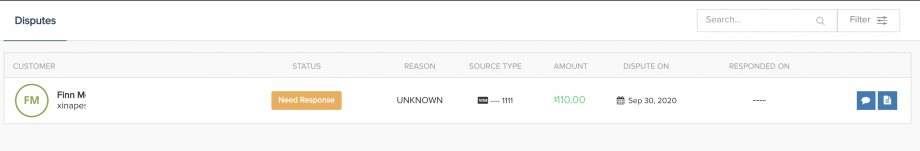

If a customer submits a charge dispute related to your CONNECT account, you will see it in this section to review and submit chargeback evidence. *Note: Only disputes with CONNECT will show in this section. Not disputes from other payment gateways.

Disputes will show one of the following statuses:

– Needs Response: Waiting on the vendor to submit evidence.

– Pending: In review with CONNECT team.

– Reviewing: In review with customers bank.

– Won: Dispute won by vendor. Vendor keeps payment.

– Lost: Dispute lost by vendor. Money will be returned to customer.

*If a dispute is lost, a $15 lost dispute processing fee will be applied to the CONNECT account.

Inside of each dispute you are able to review purchase and dispute details, submit dispute evidence, ban the customer and more.